We all use our debit and credit cards for shopping, eating out and most of our users for playing slot machine games available for Visa payment system. Soon you can do so with the added security benefits of an EMV chip card. The new cards are nearly impossible to counterfit, and travel will be even easier in more than 130 countries where chip cards are already used. EMV chip cards do eveything magnetic stripe cards do but even more securely; plus, you are still protected from fraud by Visa’s Zero Liability policy. So let’s see why using the Visa as deposit methods for online casinos is still useful and safe payment method.

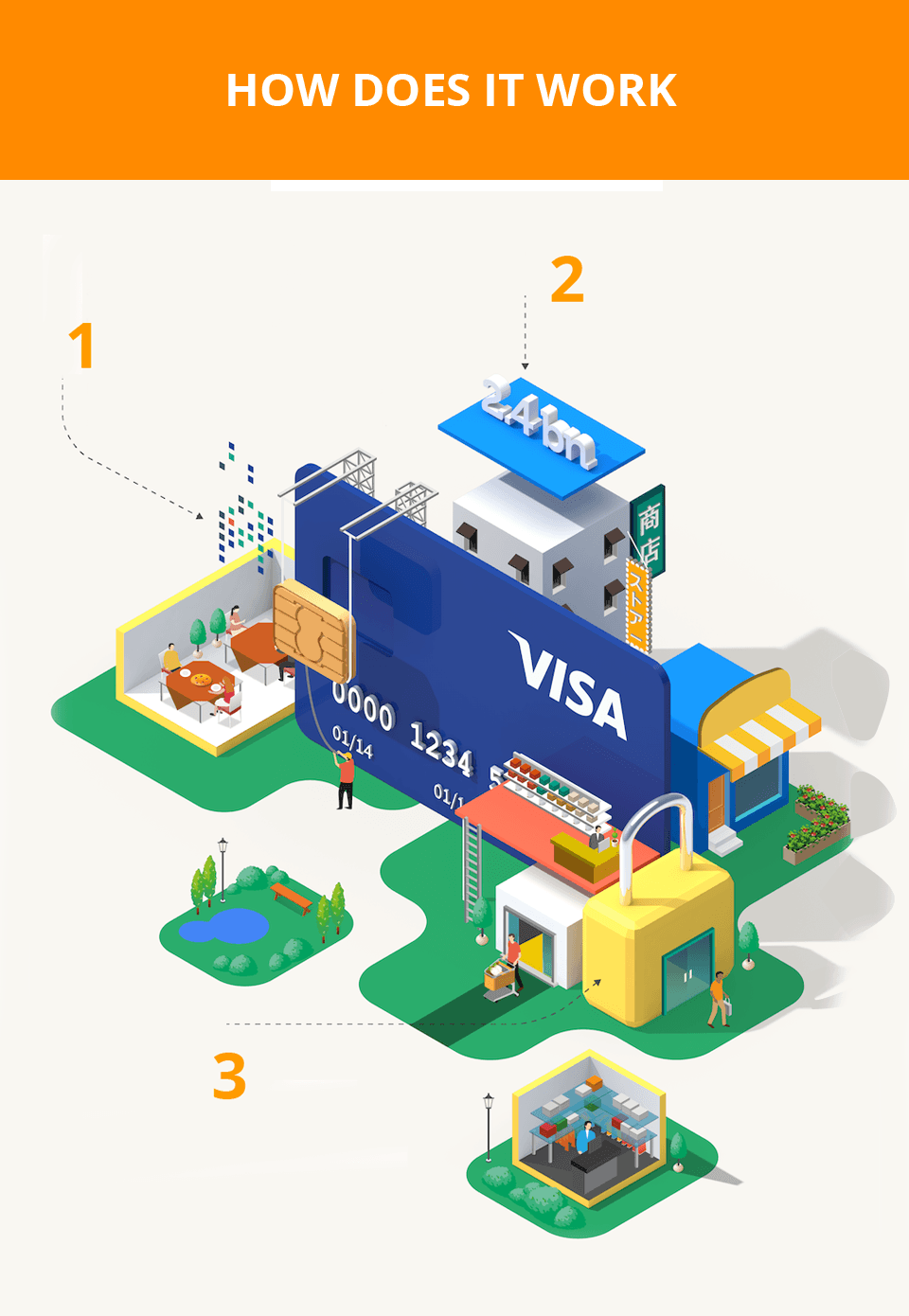

1. Smarter Technology

- Computer Microchip. A computer chip securely stores the card data that currently resides on the magnetic stripe. This makes it nearly impossible for a criminal to create a counterfeit EMV chip card.

- Unique Cryptogram. The computer chip enables more secure processing by producing a one-time use code for each transaction.

- Mobile Shopping. EMV technology will also enable a one-time use code for mobile transactions and support other security innovations lik tokenization.

2. Used Worldwide

Used Worldwide. 130+ Countries. Outside the United States EMV CHip cards are Accepted at approximately 65% of merchant terminals, ensuring you can use your account conveniently wherever you travel.

3. Added Security

- Difficult to Counterfeit. Because EMV chip cards use cryptograms that are unique to each transaction. stolen ship card cannot be used to createe counterfit cards.

- Less Risk of Fraud. The added layer of security provided by EMV chips makes the credit card data much less valuable, decreasing incentive for fraudsters to steal data.

- Zero Liability. With EMV chip cards, cardholders are still protected from fraudulent purchases with Visa’s Zero Liability policy.

How Does It Work?

- Insert Card. Instead of swiping, you’ll insert the card into the terminal, chip first, face up.

- Leave the Card in the Terminal. The card must remain in the terminal during the entire transaction.

- Sign the Receipt or Enter a PIN. Either sign the receipt or enter your PIN to complete the transaction.

- Remove your card. When the purchace is complete, remember to take your card with you.

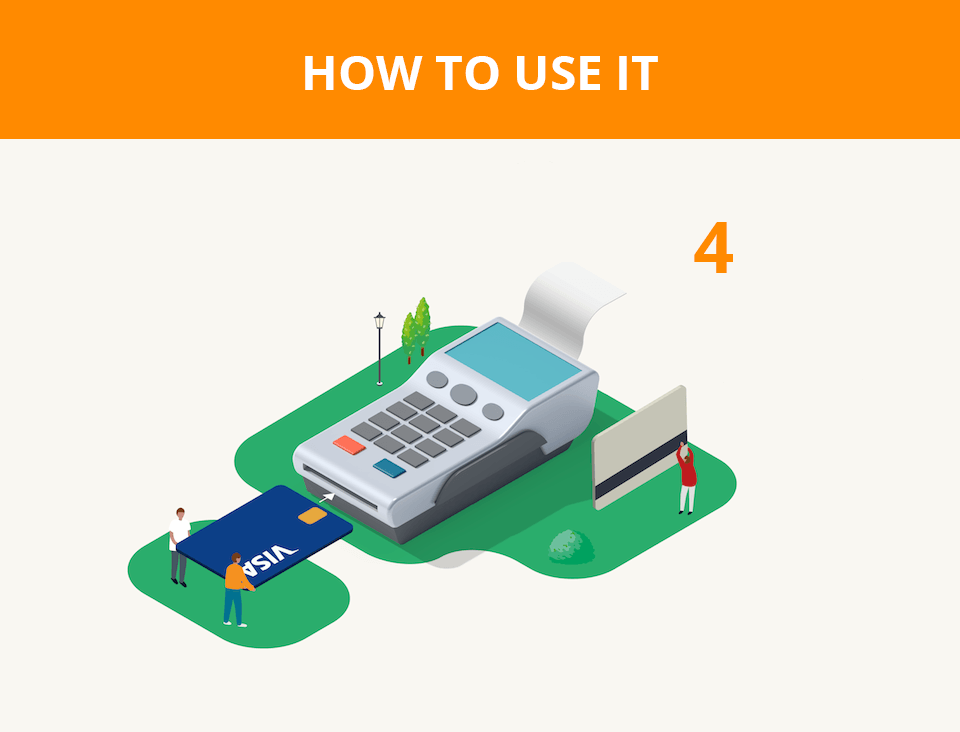

4. Remeber

The chip card still has a magnetic stripe, just in case you need to use it with a traditional terminal.

Payment Security in Multiple Layers

Visa connects the world through secure commerce and is a constantly working to protect your payment information. Visa’s global fraud rate is less than 6 cent for every $100 transacted – ehich about one-third rate experienced in the 1990s. Whether you are shopping online, using your phone to pay, or buying groceries at the store, here are some of the ways Visa protects you from fraud.

5.?Visa Chip Technology

- Visa Chip technology. Is a microprocessor which can be found embedded in certain platic payment cards and other payment devices such as mobile phone. Chip technology protects in-store payments cards by generating a unique, one-time code tha’t’s virtually impossible to replicate by counterfeit cards.

- Point-to-point Encryption.?Encryption protects payment data as it travels through payment systems by securely locking sensitive account information as a transaction is being processed. The data can’t be read and reused if it is stolen or compromised.

6.?Predictive Fraud Analytics

Our payments network, VisaNet, uses advanced fraud monitoring and detection systems to prevent fraud. In less time than it takes for the receipt to print out, Visa analyzes and risk scores every transaction it processes – more than 61 billion annually – and provides intelligence to help merchants and financial institutions identify fraud and stop it in its tracks.

7.?Transaction Alerts

- Email Alerts. You can receive near real-time text or email alerts when transactions are made using your payment account. You can track spending as well as quickly identify suspicious transactions. Issuers can also offer interactive alerts that allow you to conveniently respons beck if a transaction is valid or fraudulent.

- Device ID.?When shopping online or using a mobile device, information about the device can help refine fraud detection analytics, making mobile- and e-commerce even safer.

8. Special 3 Digit Code

Shown on the back of your credit or debit card, this security code lets e-commerce merchants know what that you’re physically holding the card when you make a purchace and adds another layer of protection against fraud.

9.?Verified by Visa

With Verified by Visa, issuers can analyze and risk score e-commerce purchaces to identify potentially fraudulent ransactions. Cardholders can be asked for a password or be sent a text message with a dynamic one-time passcode to verify transactions and prevent e-commerce fraud.

10. Tokenization

Tokenization is a technology that replaces sensitive payment account information found on plastic cards with a digital account number of “token”. Because “tokens” do not carry a consumer’s payment account details, such as the 16-digit account number, they can be safely stored by onlin merchants or on mobile devices to facilitate ecommerce and mobile payments.

11. Fraud Protection

Suspicious activity is quickly detected and measures are taken to stop fraud as it happens.?Wether it is in-store, online or using mobile, your payment card’s activity is carefully mentioned in real time, all the time by VisaNet.

12.?Added Security

Visanet gives your payment card added protection from potential fraud, theft or unauthorized use before it occurs.

13. VisaNet

Visa’s centralized network oversees every payment card transaction in great detail.

Text Alerts for Suspicious Activity

Visa’s interactive mobile alerts service sends an SMS text message directly to your phone asking for verification when a suspicious transaction occurs, giving you control of your card’s security.?Sign up through your financial institution to activate interactive mobile text alerts on your mobile.

14. Receive

If suspicious activity is detected, you will receive an text message on your phone asking you to verify the transaction.

15.?Respond

Simply reply “yes” to verify the transaction or “no” to initiate fraud protection.

If the transaction looked suspicious and you replied ‘no’ to the text alert, visaNet will take fraud prevention measures and decline the transaction.

17.?Convenient

If the transaction looked suspicious and you replied ‘no’ to the text alert, visaNet will take fraud prevention measures and decline the transaction.

18. 24/7 Protection

Two-way alerts protects your card and its financial information 24/7.

?

Thanks for Your Attention!

This work was originally made by

Jing Zhang Illustrator & Designer

Contact

Email: [email protected]

Twitter: @mazakiiz

Dribble: @mazakii

Tumblr: mazakii.tumblr.com